2023 was a remarkable fund year

- Assets grow by nine per cent

- Equity funds and bond funds with inflows, balanced funds with outflows

- Spezialfonds manage EUR 1,260 billion for retirement benefit schemes and insurers

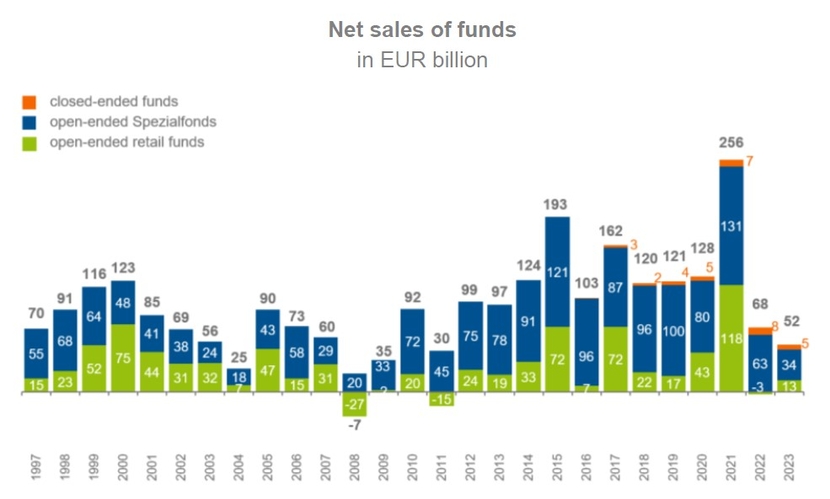

‘2023 was marked by geopolitical crises, ongoing inflation, and the comeback of interest rates. Against this backdrop, the industry recorded remarkable new business in Germany with a total of EUR 63 billion in funds and mandates,’ says Dirk Degenhardt, President of the German Investment Funds Association BVI. In terms of sales of open-ended retail funds, there was a turnaround compared to the previous year. Following outflows of EUR 3.4 billion in 2022, they received a total of EUR 12.9 billion in new money in 2023. In the institutional business only, sales totalled EUR 49.5 billion. Of this, EUR 33.7 billion was attributable to open-ended Spezialfonds, EUR 10.9 billion to mandates and EUR 4.9 billion to closed-ended Spezialfonds. ‘In 2024, fund sales started positively. This reflects the good sentiment on the equity markets at the end of last year,’ says Degenhardt.

In Germany, assets under management for private and institutional investors rose by nine per cent to EUR 4,149 billion in 2023. Over a ten-year period, it has almost doubled. ‘Once again, this confirms the attractiveness of the German market. More than 600 asset managers from almost 40 countries are active here, in addition to Germany, mainly from the USA, the UK, France and Switzerland,’ says Degenhardt. According to the European Central Bank, Germany is the largest fund market in the EU with a share of 27 per cent.

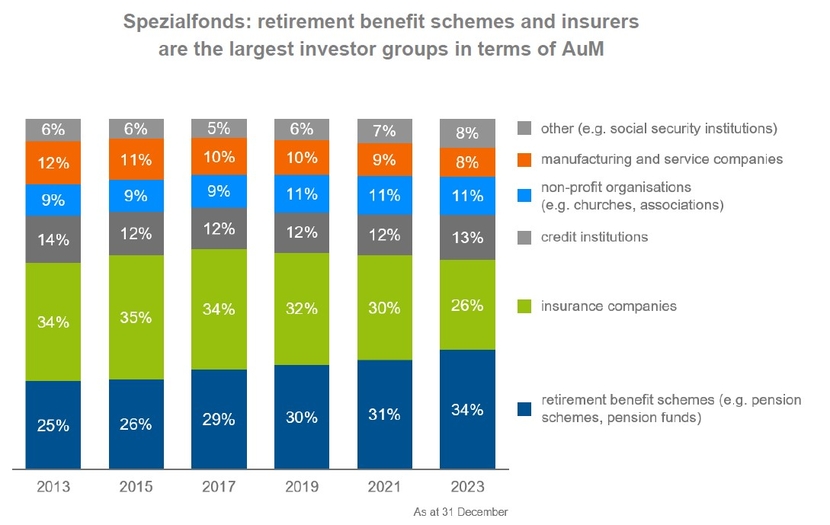

Open-ended Spezialfonds are the largest fund group in Germany, with assets totalling EUR 2,079 billion. Together with mandates worth EUR 634 billion, almost two thirds of total assets are attributable to business with retirement benefit schemes and insurance companies, for example. Open-ended retail funds account for EUR 1,382 billion and closed-ended funds for EUR 54 billion.

The sales list of retail funds is led by equity funds with inflows of EUR 12.9 billion in 2023. In the previous year, they received EUR 0.5 billion in new money. While investors mainly bought funds that invest globally (EUR 16.9 billion), EUR 3.2 billion flowed out of equity funds with focus on Germany. Of the total inflows, EUR 10.2 billion were attributable to ETFs and EUR 2.7 billion to actively managed equity funds. The assets of equity funds rose by 17 per cent to EUR 624 billion last year. The rise in interest rates led to attractive prospects for bond funds. This is reflected in the turnaround in new business. After outflows of EUR 16.5 billion in the previous year, they received EUR 12.7 billion in net new money in 2023. Corporate bond funds dominate with EUR 4.9 billion and euro bond funds with EUR 4.5 billion. With inflows of EUR 7.9 billion, bond ETFs account for more than half of the new business. The assets of all bond funds totalled EUR 211 billion. Money market funds are in third place on the sales list with EUR 4.1 billion. They manage assets totalling EUR 39.4 billion.

New business in property funds declined last year. After inflows of EUR 0.7 billion in the first quarter of 2023 and EUR 0.3 billion in the second quarter, the funds recorded redemptions of EUR 0.1 billion in the third quarter and EUR 0.8 billion in the fourth quarter. New business in 2023 totalled EUR 0.1 billion. Property funds manage net assets of EUR 131 billion. After many years at the top of the sales list, balanced funds recorded outflows of EUR 15.5 billion in 2023. Of the outflows, EUR 6.9 billion were attributable to funds with large bond exposure, EUR 5.6 billion to funds with small bond exposure and EUR 3 billion to funds with large equity exposure. Overall, balanced funds manage assets totalling EUR 338 billion.

Open-ended Spezialfonds recorded inflows of EUR 33.7 billion. Their new business is significantly lower than in the previous year, when Spezialfonds received EUR 62.7 billion.

In terms of assets under management, retirement benefit schemes are the largest group with EUR 716 billion. These include occupational pension schemes, for example. Insurance companies have invested EUR 541 billion in Spezialfonds. Together, these two groups account for 60 per cent of total assets. These figures clearly show once again that the asset management industry plays an important role in old-age provision in Germany.